An annuity that gives you guaranteed payments, for the rest of your life, may seem attractive. But it likely comes with fees and restrictions that may be hard to decipher. Furthermore, the net benefit to you may be less than you think, and more expensive than other options. Still, for some, certain annuities make sense. The key questions are:

- What's an annuity, and do you need one?

- How can you find the best annuities from the best companies?

- What annuities should be avoided, because better alternatives are available?

Worked Examples

Here are some examples of Single-Premium Immediate Annuities (SPIAs) and other options. They are based on actual quotes and real products, for a hypothetical married couple in their late 60's, seeking to invest $100,000 from an existing retirement account, with 100% benefits to be paid as long as either spouse lives. Although the quotes and products are genuine, I've made the companies anonymous because they may not operate in the state where you live, your age and other variables may differ, and the companies may impose contractual stipulations that depart from the quotes and website-data available to me. These examples should not be construed as recommendations to buy any particular security or insurance product. Rather, they are intended to illustrate how you might examine and evaluate annuity options applicable in your circumstances.

- SPIA-3%. This immediate income annuity raises its payments by 3% each year. The first year's payment is $4544, a 4.54% rate on the $100,000 deposit. With a COMDEX rank of 96, the insurer is among the top 30.

- SPIA-CPI. Also an immediate income annuity, this one increases its payments by the same percentage as the previous year's increase in the Consumer Price Index. Its first year payment is $4349, or 4.34%. The insurance company's COMDEX rank is 90, which puts it solidly in the top 100.

- Rider. This variable annuity is a partnership between a well established, highly regarded investment firm and an insurance company with a COMDEX rank of 92 (the top 60). Underlying the annuity is a mutual fund invested 60% in domestic and international stocks, and 40% in domestic and international bonds. The mutual fund, if purchased by itself, would have fees under 0.2%. Purchased as a variable annuity, it has additional fees of 0.29%. A guaranteed income rider adds 1.2% more. The total fees are pro-rated as 0.127% deducted automatically every month. In year one, for a $100,000 purchase, the annuity pays you $4500 (4.5%). Net, every month that year, the insurer deducts $501.67 from your account, paying $375.00 to you and $126.67 to itself. These values may change, depending on the performance of the mutual fund. It's possible for the annuity fees to increase while the payments to you remain flat. On the other hand, a legal rider to the annuity contract guarantees that payments to you will never decrease, and stipulates a formula by which they will increase if the underlying investments rise above their value at the time of purchase.

- Self-CPI. This option is not an annuity. It's a direct investment in the same mutual fund that underlies the Rider option. But the fees are lower, under $16 monthly, because none of the annuity fees apply, and the fund is held in an IRA account with no employer-related fees. It's a self-managed plan, where the investor uses the "collared inflation" method described here and implemented in our retirement income calculator. This method starts with an initial payment of $4020 (4.02%) because of the age of the hypothetical couple. It increases the payment each year by the smaller of (a) 6.7% or (b) last year's change in the Consumer Price Index. The limit of 6.7% is a "collar" which, historically, has been necessary to protect against depleting the fund in the worst case of 40+ years in retirement with inflation initially at extreme levels.

- From January 1972 to December 2014, a 43-year retirement with wide variation in markets and inflation.

- A 21-year retirement starting in 1973, when stocks crashed then rose, and inflation started very high.

- A 21-year retirement starting in 1994, when stocks and bonds both rose and fell, but inflation was low.

Retired 43 Years, 1972-2014

First, the good news. All four options provided payments every year for 43 years. Even better, the Self-CPI option had a residual value of $209,650, adjusted for inflation, in 2014. Yes, you read that right. With the money left in 2014, the investor's heirs would have had twice the buying power of the couple's original $100,00 investment in 1972. The annuities, as annuities, had no residual value. Instead, any profits went to the insurers.

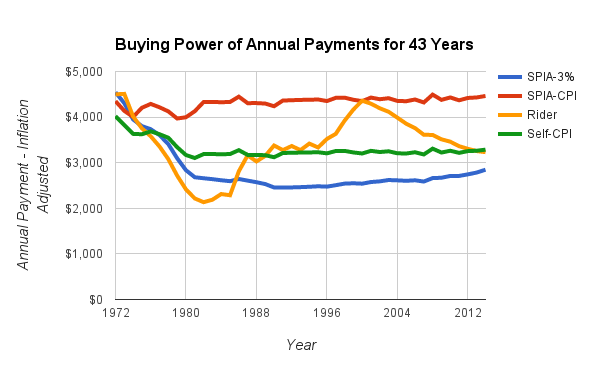

However, because 43 years is a long time, because inflation was high in the 1970's, and because the period included multiple large swings in the values of stocks and bonds, the four options paid out very different amounts from year to year. The chart below shows how they differed, over time. It's important to note that in the chart, all values are inflation-adjusted to show constant buying power, pegged to January 1972.

However, because 43 years is a long time, because inflation was high in the 1970's, and because the period included multiple large swings in the values of stocks and bonds, the four options paid out very different amounts from year to year. The chart below shows how they differed, over time. It's important to note that in the chart, all values are inflation-adjusted to show constant buying power, pegged to January 1972.

Viewed in terms of buying power, the SPIA-CPI option was the clear winner. When adjusting for last year's inflation, it sometimes lost a bit of buying power if current-year inflation was high. But over the long term, it guaranteed constant income, in real, inflation-adjusted dollars.

The SPIA-3% option underestimated the high inflation of the 1970's and never caught up. Had this annuity been purchased with a 4% annual increase instead of 3%, the initial payment would have been a bit smaller, but the decline during high inflation would have been more limited. Eventually the initial buying power would have been nearly restored, as the compound rate of inflation for the entire 43-year period was 4.14%.

The Self-CPI option, because of its 6.7% cap on annual increases, fell behind inflation in the 1970's, but leveled out from 1980 onward. In effect, this method made a trade-off. It kept a large bequest as a result of cautious withdrawals.

The Rider option, when adjusted for inflation, fell short on its promise that payments would never decrease. Yes, in nominal dollars, the same amount was paid every year throughout the 1970's, but within a decade, inflation cut the buying power of those dollars in half. When huge bull markets in stocks and bonds began in 1982, the Rider option swiftly recovered, only to lose ground again after the dot-com bubble burst in 2000. Of all four options, this one had the least consistent payouts, adjusted for inflation.

The SPIA-3% option underestimated the high inflation of the 1970's and never caught up. Had this annuity been purchased with a 4% annual increase instead of 3%, the initial payment would have been a bit smaller, but the decline during high inflation would have been more limited. Eventually the initial buying power would have been nearly restored, as the compound rate of inflation for the entire 43-year period was 4.14%.

The Self-CPI option, because of its 6.7% cap on annual increases, fell behind inflation in the 1970's, but leveled out from 1980 onward. In effect, this method made a trade-off. It kept a large bequest as a result of cautious withdrawals.

The Rider option, when adjusted for inflation, fell short on its promise that payments would never decrease. Yes, in nominal dollars, the same amount was paid every year throughout the 1970's, but within a decade, inflation cut the buying power of those dollars in half. When huge bull markets in stocks and bonds began in 1982, the Rider option swiftly recovered, only to lose ground again after the dot-com bubble burst in 2000. Of all four options, this one had the least consistent payouts, adjusted for inflation.

Two 21-Year Retirements

The foregoing analysis comes with a big caveat. It's for a very long retirement in a unique historical period. Your experience in retirement will almost certainly be different. Consider, then, two other examples, both 21 years in length, one from January 1973 to December 1993; the other, from January 1994 to December 2014.

During these two periods, the underlying mutual fund of the Rider and Self-CPI options had compound, inflation-adjusted returns a bit higher than 5% per year. In this respect, the stock and bond markets were, overall, about average during both periods, despite some dramatic swings along the way.

At 21 years, both periods were also average in another sense. They fit the joint life-expectancy of a couple in their late 60's.

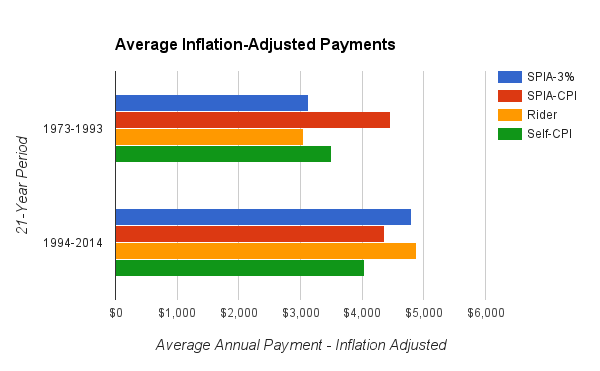

A key difference, however, is that in the first period, 1973-1993, inflation was abnormally high (6.05%), while in the second, 1994-2014, inflation was much lower (2.30%). Because of inflation, the SPIA-CPI option did the best job of maintaining payments at constant buying power in the 1973-1993 period; the other methods lost about 25%, falling close to $3000, inflation-adjusted. In the low-inflation period from 1994 to 2014, however, all the options preserved buying power, and the SPIA-3% and Rider payments actually bettered inflation. The chart below displays the average payments, after adjusting for inflation.

During these two periods, the underlying mutual fund of the Rider and Self-CPI options had compound, inflation-adjusted returns a bit higher than 5% per year. In this respect, the stock and bond markets were, overall, about average during both periods, despite some dramatic swings along the way.

At 21 years, both periods were also average in another sense. They fit the joint life-expectancy of a couple in their late 60's.

A key difference, however, is that in the first period, 1973-1993, inflation was abnormally high (6.05%), while in the second, 1994-2014, inflation was much lower (2.30%). Because of inflation, the SPIA-CPI option did the best job of maintaining payments at constant buying power in the 1973-1993 period; the other methods lost about 25%, falling close to $3000, inflation-adjusted. In the low-inflation period from 1994 to 2014, however, all the options preserved buying power, and the SPIA-3% and Rider payments actually bettered inflation. The chart below displays the average payments, after adjusting for inflation.

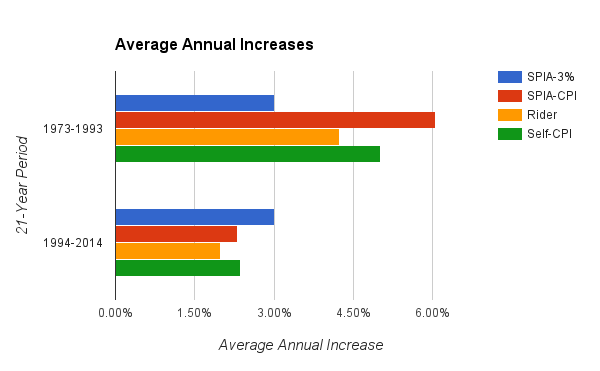

As shown in the next chart, only SPIA-CPI generated annual increases that kept pace with the 6% rate of inflation in the first period, while all the options matched or beat the tame 2.3% rate of inflation in the second period.

Finally, as with the 43-year analysis, the Self-CPI option was unique in preserving a bequest. Adjusted for inflation to reflect constant buying power, Self-CPI preserved principal approximately equal to the initial investment, in both 21-year periods: $90,756 at the end of 1972-1993, and $144,631 at the end of 1994-2014. The three annuities, by design, left nothing.

Summing Up

The examples presented here are for selected options and time periods. As such, they cannot be taken as guarantees of future performance or as definitive recommendations of certain products. Your results may differ, and will, as with any investment, entail a risk of loss. With those important cautions in mind, consider the following key insights from these examples:

- If one's goal were to guarantee constant buying power, SPIA-CPI would have been the best of the options examined above. A SPIA with a 4% or 5% annual increase might have performed comparably for periods of high inflation, but would have been more than necessary under normal levels of inflation.

- If one's goals were to preserve constant buying power and also leave a bequest, Self-CPI would have been the best of the options studied here. However, it would require active management by the investor (or by a paid adviser), which sets it apart from the annuity options.

RSS Feed

RSS Feed