Suppose from 1944 to 1969, you held and rebalanced a portfolio matching the S&P 500 index and 10-year U.S. Treasury bonds. Would that have been the optimal investment strategy for those 25 years? This post answers the question, using data similar to posts earlier this week on recent 25-year periods for the Nikkei 225 in Japan and the Dax 30 in Germany. It's all part of a series that follows up my June 3 post about current U.S. markets, What Now: Sell, Rebalance, or Rotate?

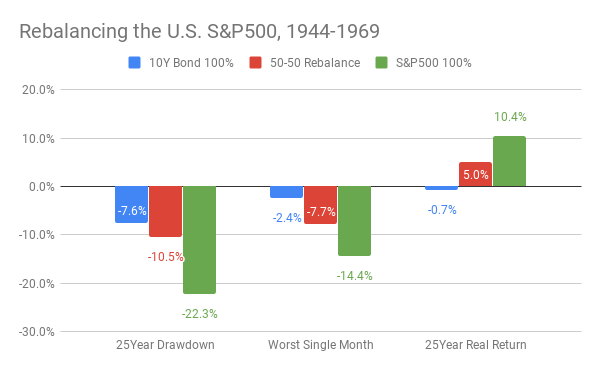

Comparing this chart to the previous ones for Japan and Germany, one difference stands out. Stocks were indisputably the superior investment. The worst drawdown in the total return of the S&P 500 from April 1944 through March 1969 was -22.3%. In the usual parlance, that's merely a "correction," not a "crash." In the worst single month, had you held all your money in stocks, your loss on paper would have been -14.4%. Those drawdowns, admittedly not small enough to match Treasury bonds, were far less painful than the maximums exceeding -65% and the monthly values around -25% for stock-portfolios in Japan and Germany from 1994 to 2019.

Remarkably, the cumulative real return of an all-stocks portfolio in the U.S., from 1944 to 1969, was 10.4% per year. After inflation! Incredible. The real buying power of your dollars would have grown 11-fold in 25 years. Of course, you had to be there. You had to be alive then with money to invest. And you had to be smart enough or lucky enough to place all your chips on stocks, at a time when the world war was not yet over, the G.I. Bill not yet conceived, the baby-boom not begun, interstate highways unknown, air-travel restricted to the wealthy, and rationing of necessities the norm. Maybe you would have foreseen that there was nowhere to go but up.

Or maybe the habits of rationing food and buying war-bonds would have inclined you toward the perceived safety of Treasuries. What a mistake that would have been! Over the next 25 years, your real returns would have gone negative. Treasury bonds, in that period, were anything but safe. Cumulatively, they suffered a -16% loss in buying power, as their -0.7% real rate of return compounded. No single month announced this loss. The worst one was merely -2.4%. Japan's and Germany's more recent government bonds had monthly drawdowns twice that amount, but they also had more numerous months of positive, inflation-adjusted returns that generated real gains in the long run.

The quarter-century from 1944 to 1969 was, coincidentally, when the Bretton Woods Agreement governed global currencies. It made the dollar dominant, governing world markets, for better or worse, by the force of U.S. ownership of the majority of the world's gold. Interest rates in the U.S. were capped for many years early in that period, for fear of post-war deflation, when the reality was an inflationary spike in prices. Then, when interest rates were belatedly allowed to rise, they did so slowly but inexorably for the rest of the period, causing bond prices to fall, also slowly and inexorably. Perhaps misguided monetary governance like this will never happen again. Or maybe not this pattern in particular, but another one crafted in a future time of uncertainty, with similar unforeseen and unhappy consequences. We won't know until, if, and after it may happen.

In the final analysis, the U.S. experience from 1944 to 1969 conveys the same lesson as did the German and Japanese results for 1994-2019. Had a post-war investor in the U.S. opted for the compromise of investing half in stocks and half in Treasuries, rebalancing them monthly to 50-50, if needed, when they drifted to 45-55, then the outcome after 25 years would have been quite satisfactory. In round numbers, the maximum drawdown would have been a tolerable -10%; the worst month, only -8%; and the annualized real return, a handsome 5%.

Summing up the three cases, we have one (Japan, recently) where going all-in on bonds was best; another (the U.S., a half-century earlier) where that would have been a disaster; and two where stocks were best, once by a small amount (Germany, recently) and once by a huge margin (the post-war U.S. again). A rebalancing strategy was never best nor worst, yet all three times it beat inflation. The rub, however, is that rebalancing only partly managed the problem of severe drawdowns.

Next week, posts in this series will continue with a fresh look at a different strategy, rotation, to examine whether it can succeed when rebalancing comes up short.

Remarkably, the cumulative real return of an all-stocks portfolio in the U.S., from 1944 to 1969, was 10.4% per year. After inflation! Incredible. The real buying power of your dollars would have grown 11-fold in 25 years. Of course, you had to be there. You had to be alive then with money to invest. And you had to be smart enough or lucky enough to place all your chips on stocks, at a time when the world war was not yet over, the G.I. Bill not yet conceived, the baby-boom not begun, interstate highways unknown, air-travel restricted to the wealthy, and rationing of necessities the norm. Maybe you would have foreseen that there was nowhere to go but up.

Or maybe the habits of rationing food and buying war-bonds would have inclined you toward the perceived safety of Treasuries. What a mistake that would have been! Over the next 25 years, your real returns would have gone negative. Treasury bonds, in that period, were anything but safe. Cumulatively, they suffered a -16% loss in buying power, as their -0.7% real rate of return compounded. No single month announced this loss. The worst one was merely -2.4%. Japan's and Germany's more recent government bonds had monthly drawdowns twice that amount, but they also had more numerous months of positive, inflation-adjusted returns that generated real gains in the long run.

The quarter-century from 1944 to 1969 was, coincidentally, when the Bretton Woods Agreement governed global currencies. It made the dollar dominant, governing world markets, for better or worse, by the force of U.S. ownership of the majority of the world's gold. Interest rates in the U.S. were capped for many years early in that period, for fear of post-war deflation, when the reality was an inflationary spike in prices. Then, when interest rates were belatedly allowed to rise, they did so slowly but inexorably for the rest of the period, causing bond prices to fall, also slowly and inexorably. Perhaps misguided monetary governance like this will never happen again. Or maybe not this pattern in particular, but another one crafted in a future time of uncertainty, with similar unforeseen and unhappy consequences. We won't know until, if, and after it may happen.

In the final analysis, the U.S. experience from 1944 to 1969 conveys the same lesson as did the German and Japanese results for 1994-2019. Had a post-war investor in the U.S. opted for the compromise of investing half in stocks and half in Treasuries, rebalancing them monthly to 50-50, if needed, when they drifted to 45-55, then the outcome after 25 years would have been quite satisfactory. In round numbers, the maximum drawdown would have been a tolerable -10%; the worst month, only -8%; and the annualized real return, a handsome 5%.

Summing up the three cases, we have one (Japan, recently) where going all-in on bonds was best; another (the U.S., a half-century earlier) where that would have been a disaster; and two where stocks were best, once by a small amount (Germany, recently) and once by a huge margin (the post-war U.S. again). A rebalancing strategy was never best nor worst, yet all three times it beat inflation. The rub, however, is that rebalancing only partly managed the problem of severe drawdowns.

Next week, posts in this series will continue with a fresh look at a different strategy, rotation, to examine whether it can succeed when rebalancing comes up short.

RSS Feed

RSS Feed